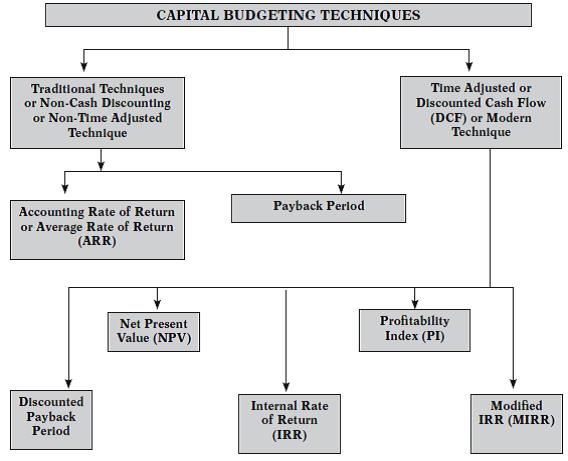

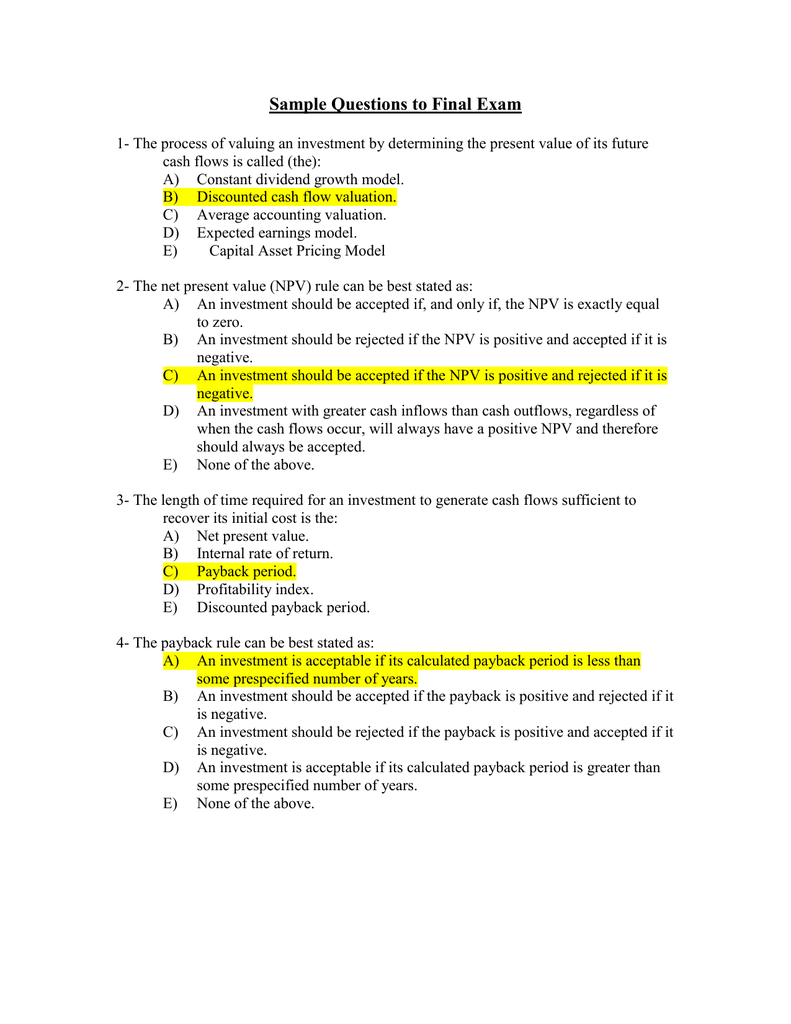

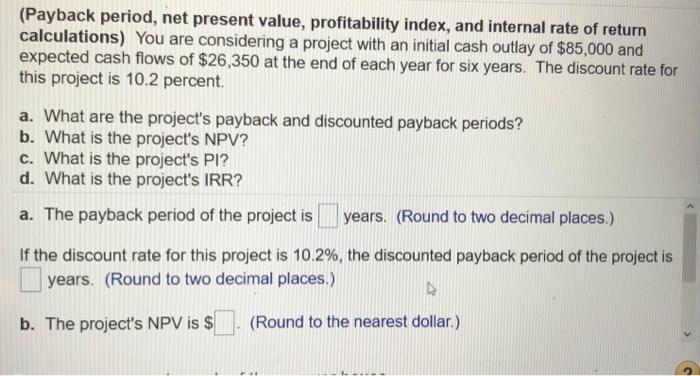

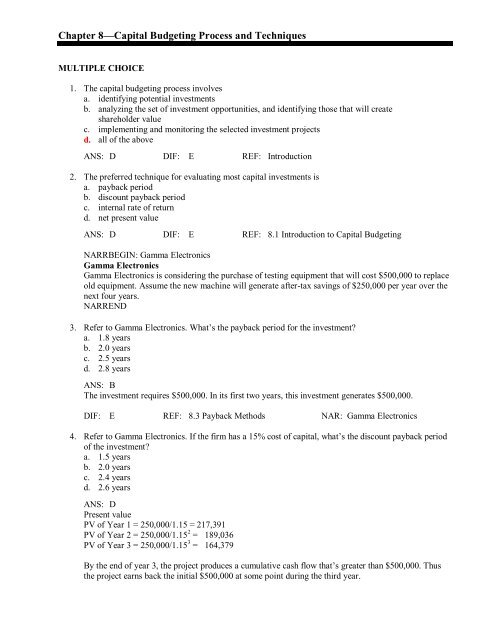

CAPITAL BUDGETING Decision methods: Payback period, Discounted payback period, Average rate of return, Net present value, Profitability index, IRR and Modified IRR (Theory & data interpretation): Sekhar, Chandra: 9781980203452: Amazon.com: Books

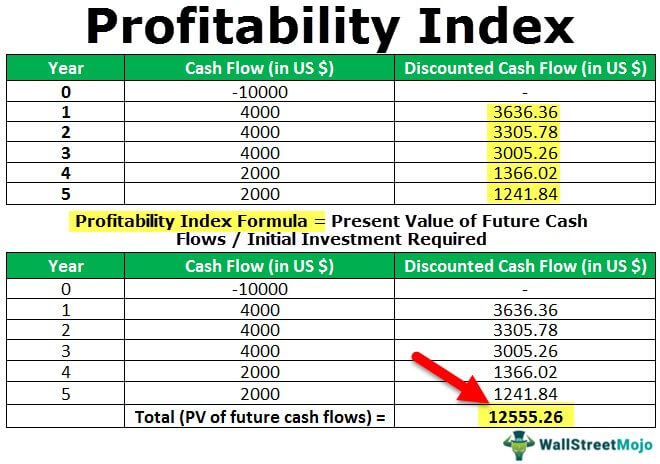

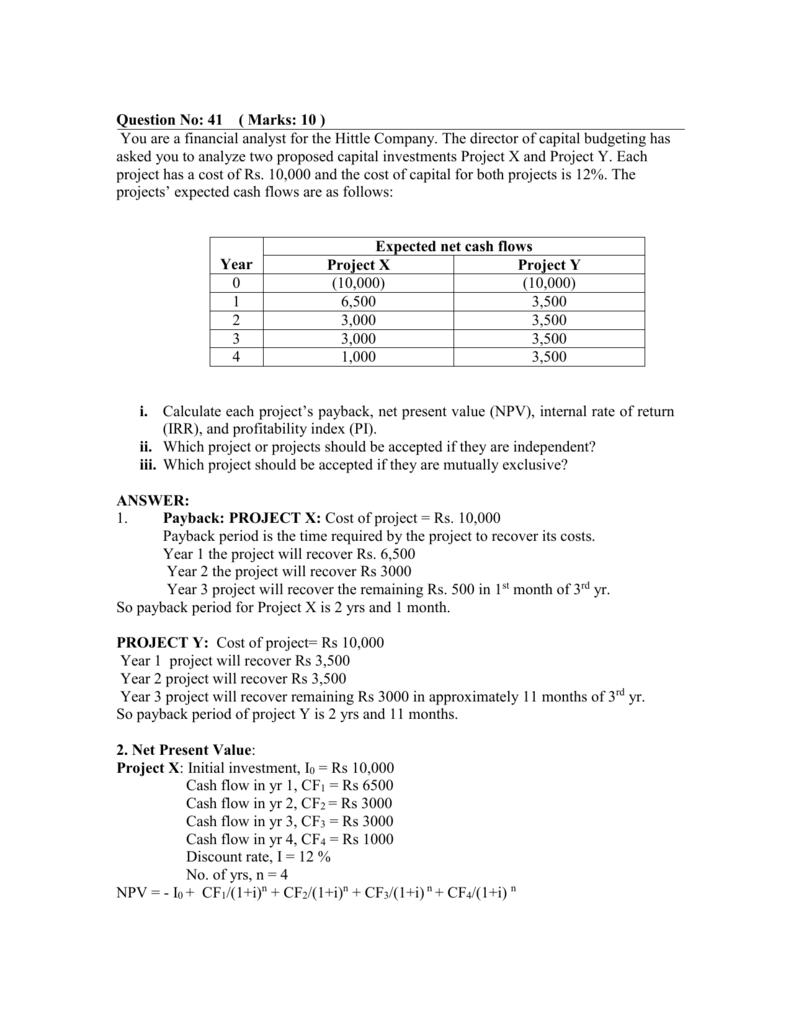

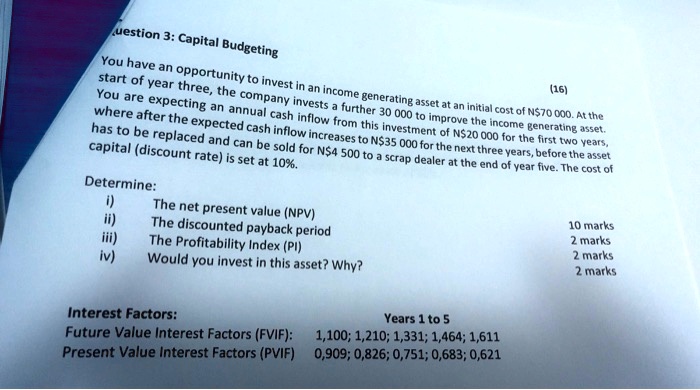

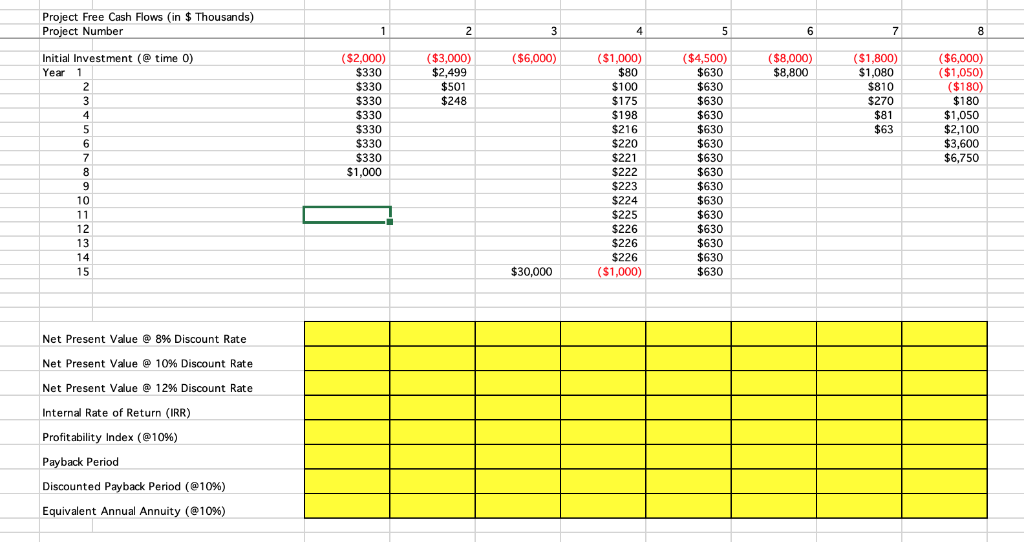

SOLVED: uestion 3:Capital Budgeting (16) capital (discount rate) is set at 10% Determine: i) The net present value (NPV) ii) The discounted payback period iii) The Profitability Index (PI) iv) Would you

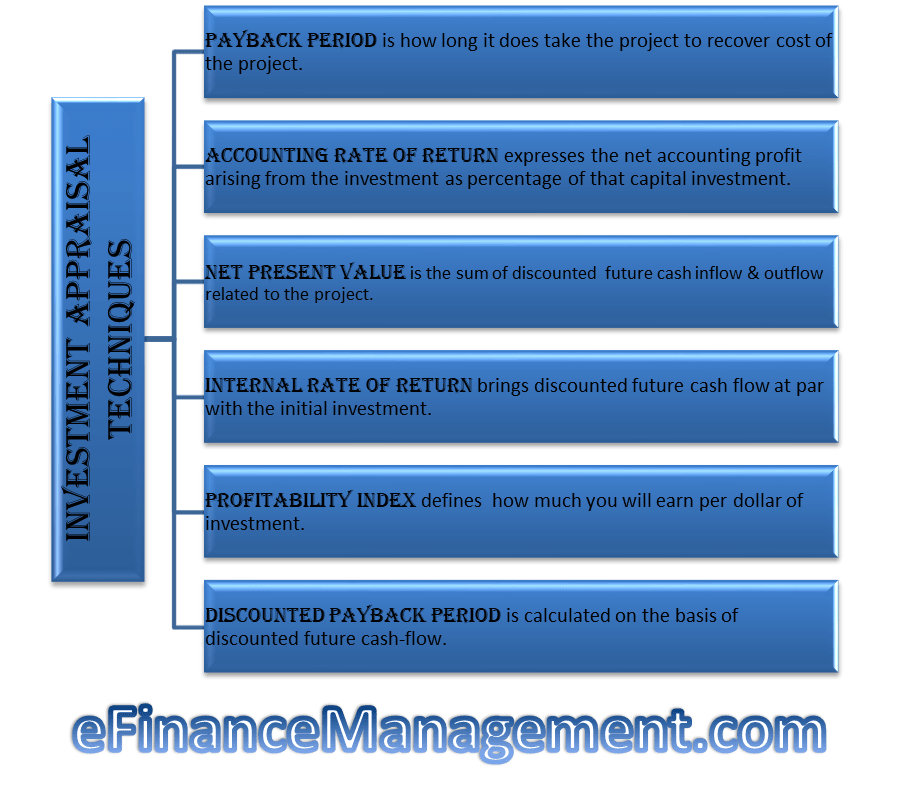

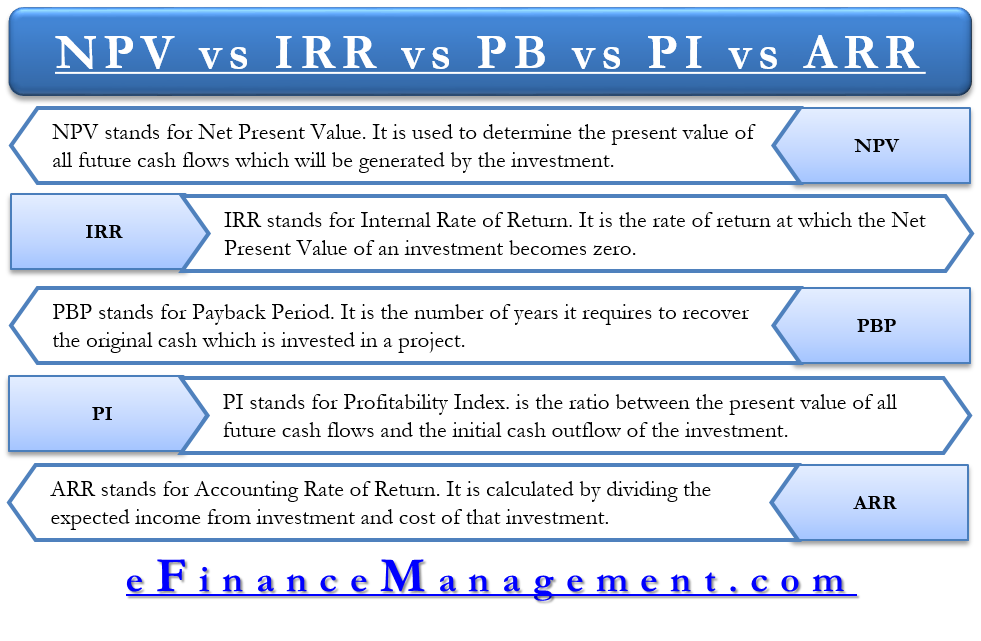

Net present Value, Internal Rate Of Return, Profitability Index, Payback, discounted payback, Accounting Rate Of Return

:max_bytes(150000):strip_icc()/dotdash_final_Profitability_Index_Oct_2020-011-3cc06137c4e24b7dbef3515c7d989bd3.jpg)