Federico NARDARI | Professor (Full) | University of Melbourne, Melbourne | MSD | Department of Finance | Research profile

🎄Jingle bells 🎄 intepretato da Mario Biondi... ah no! e' Federico Nardari 2A!🤣👏👏 | By Istituto Gonzaga SPORT PAGE | Facebook

Federico NARDARI | Professor (Full) | University of Melbourne, Melbourne | MSD | Department of Finance | Research profile

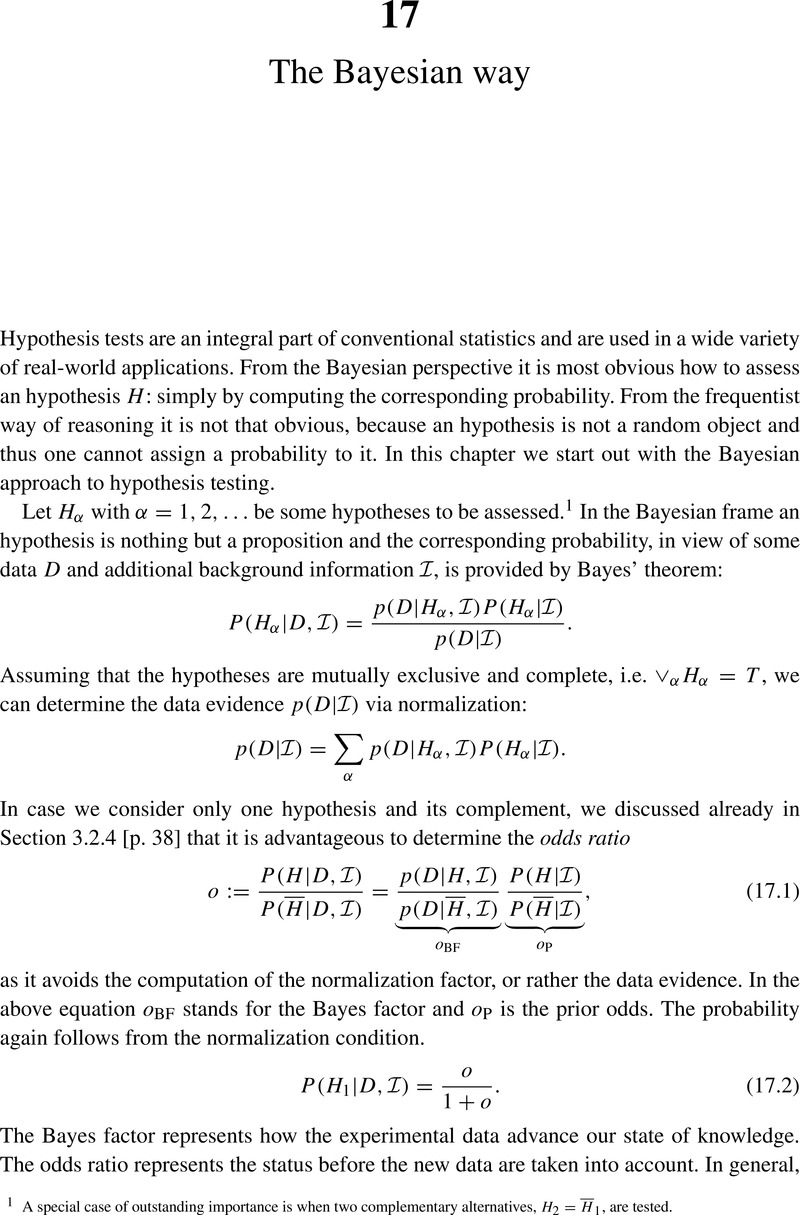

Do Model and Benchmark Specification Error Affect Inference in Measuring Mutual Fund Performance?* Jeffrey L. Coles Department

Sample selection bias, return moments, and the performance of optimal versus naive diversification (Job Market Paper)

2011 Annual Report FBE by The Faculty of Business and Economics, The University of Melbourne - Issuu

Bayesian Analysis of Linear Factor Models with Latent Factors, Multivariate Stochastic Volatility, and APT Pricing Restrictions

The Joint Dynamics of Liquidity, Returns, and Volatility Across Small and Large Firms Tarun Chordia,* Asani Sarkar,** and Avanid

Federico NARDARI | Professor (Full) | University of Melbourne, Melbourne | MSD | Department of Finance | Research profile